Recently there was a call for “urgent” action regarding the City’s financial situation. Along with various criticisms of a lack of action, or not enough action, it seems strange that now there is a sense of urgency, where there was no urgency over the last several years if not longer. While there may be plenty of blame to go around, it is more productive to focus forward on how we proceed from here. I’ve been writing about what actions the city has taken since I became Mayor quite regularly, however as we approach the end of the year, I think it useful to share the holistic vision with how and the order in which I approach this and all problems.

- Step 1: Determine if there is a Problem

- Step 2: Understand the Ccope of the Problem

- Step 3: Understand the Causes of the Problem

- Step 4: Evaluate Potential solutions for the Problem

- Step 5: Decide on a Course of Action and Execute

When the people of Clayton re-elected me in 2022,

I made a commitment to not push for any tax increase unless it was a last resort. This means going through a comprehensive process to first understand if there was a problem, determine the scope of the problem, the causes of the problem, and evaluate potential solutions. Only then could a course of action be decided upon and executed.

Step 1: Determine if there is a Problem In terms of financial projections, these are relatively new for Clayton. The first time the Council saw a

5 year forecast was in June of 2021 and it showed The forecast showed a projected deficit at the end of FY 2023 of approximately $200K.

This is when I first raised the issue of the City’s financial challenges. Based on the projection we received, I wrote in detail regarding the financial position that the city was in and began asking for input from our residents. This was done in hopes that we would spur conversation and discussion at the city. This would only be the beginning of Step 1. From this point, we should have had substantial discussion with sufficient time to validate the information, brainstorm about causes, and discuss potential actions.

But it

wasn’t until late September 2021 that we actually discussed this issue again, and even then it was only to say that we were interested in having that discussion. From September 2021 through November of 2022, the only action the City took was to

squander $30K to determine if our residents would

support a $400/parcel tax. Before even completing Step 1 our previous Council majority jumped right to Step 5 and floated the idea of a tax that would generate nearly $1.8M per year.

The Council received

another projection in February of 2022. Rather than the approximate $200K deficit projected at the end of FY 2023 that was previously indicated, at that point the deficit was projected to be approximately $100K – a significant improvement in just 8 months. And again, in February of 2023, the forecast for the end of FY 2023 the forecast changed. Instead of a $100K forecasted deficit, we were now expecting a surplus of approximately $80K at the end of FY 2023. To be clear, a significant portion of the changes in forecast were related to staffing vacancies. But this goes to Step 2 – we need to understand the scope of the problem because that will have a significant impact in how we discuss the situation and what the potential solutions may be.

Step 2: Understand the Ccope of the Problem The City clearly has unmet needs. We have been slow to make technology and infrastructure upgrades over time and multiple areas in the City’s operations are decaying as a result of end of life. When I became Mayor one of the first things I did was to direct our City Manager to work with staff and provide a list of what would make their jobs more efficient, or things they wanted to improve their ability to deliver services.

And we moved quickly on these items. For example, security at City Hall has been improved with updated cameras and electronic access control. We authorized the purchase of new equipment for our Maintenance team to make their work more efficient. We’ve been pursuing new tools to help with GIS mapping, code enforcement, and permitting to make work in our Community Development Department more efficient. We’ve engaged vendors to make basic processes like managing Council agendas more efficient as well. All of these things were left to languish before the current Council decided to take action.

While these areas are part of the challenges the City faces, they are not all of them. There are multiple areas in the City where structural imbalances are not sustainable at current service levels. The two largest of them are the Oakhurst Geological Hazard Abatement District (GHAD) and general maintenance. Understanding all of the areas where the City may be falling short is critical to Step 2.

When I first came on the Council I began asking questions about the GHAD. In fact, at every meeting of the GHAD, I requested that staff prepare a report that outlined the activities of the GHAD, what has been performed and how often those activities are scheduled. And for four years, this was not prioritized so it was never clear the level of deficiency in the GHAD. It wasn’t until I became Mayor and pressed staff to do the work necessary to understand the scope of the GHAD deficiencies that we learned the current state of affairs. After over 4 years, we got this information back

in March of 2023.Understanding the scope of the problem is even more pronounced in the Maintenance area. Immediately after I began asking questions about the GHAD, I made the same requests for our regular maintenance work. And the result was the same – no actual information about the level of effort, when things were being done, etc. Again, it wasn’t until I became Mayor that I pressed for these issues to be brought to the fore. After we hired our current City Manager, I suggested that we keep the Interim City Manager on to perform an actual maintenance assessment. Because the former Interim City Manager was familiar with the City and was a former Public Works Director, they could jump start this work that hadn’t been done after years of requests – assessing where time was spent and what level of effort was needed to do all of the things in the City. After over 4 years, we just received this information back

in October 2023.

Step 3: Understand the Causes of the Problem Given the City’s limited budget and our primary costs and sources of revenue, it’s clear that we have financial challenges. The vast majority of General Fund revenue that the City earns, near 60%, is related to property taxes. Because of the protections from Prop 13, property tax revenue increases are typically limited to 2% per year unless a house is sold. The majority of the City’s expenses are from wages, which have been rising faster than 2%.

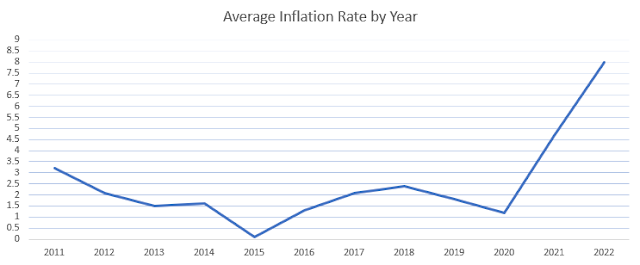

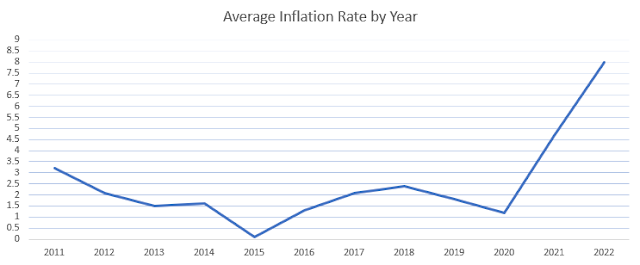

From:

https://www.usinflationcalculator.com/inflation/current-inflation-rates/

These two factors combined are the biggest cause of the City’s financial challenges. From 2011 – 2020, average inflation in the U.S. was 1.73%. Starting in 2021, inflation increased to 4.7% and in 2022 rose to 8%. Inflation has come down a bit in 2023 thus far, but it remains significantly elevated from prior years. If the cost of goods, including wages, rises at these levels while revenue growth is limited, this will continue to drive deficits. This goes to Step 3 and understanding the causes of the problem. This is likely not the only cause either. We know that unfunded mandates from the State, including reporting and compliance requirements, have increased the workload on City staff. There are likely other drivers involved as well. But until we understand the causes, any solution offered may not address the actual causes of the problem.

Step 4: Evaluate Potential Solutions for the Problem This is where a large part of the discussion should occur, and it is also the step that has been largely skipped by those raising concerns. We can see this in the proposals that have been advanced thus far. First it was the ill-conceived $400/parcel tax floated by prior Councils without understanding what our actual needs were. Why was $400/parcel chosen if at the time we didn't understand major costs like those of maintenance and the GHAD?

We can see it in the proposal to appropriate $400K in one time spending for one year of supplemental landscaping work. Why would we choose to spend $400K of reserves with no plan on how to proceed after the first year? These types of approaches are deficient for different reasons. The first is because it jumps to Step 5 without understanding what we are trying to solve for. The second is because it doesn’t contemplate anything other than increased spending.

There is a consistent bias in government – to try and solve problems by spending more of the taxpayer’s money. When a previous consultant

proposed adding 4 FTEs across multiple departments, it did so without considering the cost, or the expectation of level of service in this community. When the proposal to spend $400K on one time landscaping work was brought forward, it did so without any contemplation of what alternatives exist. There was no alternative scenario outlining what would happen if we did not move forward with this spend, what action would the City then need to take to reduce service levels and what that would look like. The only thing proposed was to spend more. Understanding the holistic view is the key to any solution evaluation – the people need to know what they are buying, and what happens if they don’t. When engaging in Step 4, evaluating solutions, there needs to be a realistic look at the costs and impacts of various choices so people and the Council can make informed decisions in Step 5.

For example, on the revenue side, the City could attempt to implement a real estate transfer tax, a sales tax, a parcel tax, and/or a special purpose tax. The City could also explore alternate sources of revenue - through rental fees, spurring business growth, investment income, selling City owned property, etc. On the expense side, the City could attempt to reduce spending in certain areas, consolidate or reduce headcount, furlough staff, reduce levels of service, etc. Each option has pluses and minuses and the City should evaluate each of these prior to deciding on a course of action to execute. Step 4 has not even been broached

Step 5: Decide on a Course of Action and Execute Only after all of the above occurs would it be prudent to make decisions on how to proceed.

Of course, along the way the business of the City does not stop, and we could take meaningful action that would be beneficial to the residents of the City right from the get go. For example, this means things like:

- Addressing our Investment Policy. While we had a conservative Investment Policy, it was not being adhered to. We were locked in illiquid investments that didn’t let us take advantage of rising interest rates. We also had an excess amount of cash that was parked in a very low yield government pool of funds. This year we addressed those issues even as the Budget/Audit Committee, made up of Councilmember Trupiano and myself, overcame staff inertia that avoided investing in simple treasuries. The City has over $12M in assets to invest and after we satisfy our safety and liquidity requirements, we should expect a fair yield in today’s interest rate environment. It sounds simple, but from the time I initiated this discussion with staff to the time it was executed took approximately 5 months.

- Addressing our Master Fee Schedule. Historically no one could remember when the last time we actually performed a fee study. This means that each year, and in some cases not every year, the fees that the City charged for performing certain services would only increase by a CPI modifier, without respect to the actual cost of performing those services. By performing an actual fee study, we were able to update the Master Fee Schedule so it had automatic risers for inflation, as well as include provisions that captured actual cost so these fees can rise when actual costs rise. This had never been done before but will make all future adjustments more routine. From the time this was initiated to the time it was executed was over 9 months.

- Addressing Energy Infrastructure. The City engaged with Climatec to bring forward the largest infrastructure project in Clayton since Oakhurst was constructed. Meeting with representatives from Climatec, myself and Councilmember Trupiano worked through the deal points and what the City was willing and able to do. Together we emphasized that without the California Energy Commission funding source, the project would likely not work. It was in those working sessions that we came to understanding, and Climatec was able to pursue and secure funding for our initiative of approximately $2M at 1% interest. I conveyed the importance of this effort as a top priority to each of the three City Managers that I have worked with as Mayor and I am glad to see the work beginning. To get to this point has been over 9 months of time spent.

All of these things benefit the residents of Clayton, and the City’s financial well being. But if the problem is as dire as is being conveyed by the call for urgent action, then they are not enough.

We need leaders who won't look to raise taxes an exorbitant amount as a first option. And before we do anything else, we need to gain a better understanding of our fiscal picture so we have better information to act upon. This will take more than attending meetings and pontificating at the lectern - it is going to take real nuts and bolts work to dig into what is actually happening. It may be the case that as a community we need to decide if we want to raise taxes, or if we want less services, or some combination of both or something else. But we won’t know that unless we engage in the actual process rather than try to score political points.

A criticism I am hearing now after serving almost 1 year as Mayor is, ‘why haven't all of the problems been solved yet?’ Or ‘why wasn’t more done?’ If you’ve read this far, it is clear that much has been done, and there is more still to do. Many of these issues have been bubbling up in the background for years, but recent economic conditions have exacerbated them. Consider that since 2011, the City's General Fund unassigned reserves has been steadily trending upwards:

And as I wrote above, forecasts for the City are relatively new and as we've seen the City is still immature in how it develops them. So while the high level story from a general fund perspective did not raise alarms, it took some digging to surface some of the underlying financial issues.

It’s taken years just to get information about the amount of work needed at the GHAD and for our maintenance and landscaping. But we are now gaining momentum. Previously there was no appetite to tackle these issues but as we've seen that does not make them go away. We are now starting and will continue to dig into the operations of the City. The Council has directed staff to put together a holistic look at the City’s needs – specifically including scenarios at various levels of funding assumptions. Only from there will the people be presented with a complete picture of the options available.

I look forward to that discussion. The financial challenges of the City were not caused over night and they will not be solved over night either. It will take a concerted and prudent effort to address issues and I would hope that as a Council and community we can work together to understand and address each challenge as we move forward together.