Wednesday, December 21, 2022

My 12.20.22 Meeting Summary

Friday, December 16, 2022

Upcoming Council Meeting 12.20.22

Wednesday, December 7, 2022

12.6.22 Meeting Summary and Final Election Results

First and foremost, I want to thank my wife and family. For a largely volunteer position I am acutely aware that this role would be impossible to do without their support, and at times, grace.

I also want to thank Mr. Miller and Ms. Billeter for running. Though we may disagree from time to time on matters of policy, healthy debate and discussion is part of the process. Anyone who decides to put themselves out there for public office is to be commended on their willingness to step up and serve.

And thank you to Kim Trupiano. I look forward to working together along with the rest of the Council over the next four years.

It is clear that the city faces challenges ahead. From staffing, to budgets, to community relations, we as a Council and as a community will need to come together in various ways to address these head on. I am grateful that the residents of Clayton chose me again to represent them here on the Council. Over the last four years I have spoken to so many residents who appreciate transparency and clear communication. I will continue to update residents as best I can in the years ahead. And that starts now.

Certainly as a city we need to maintain the services that make Clayton a wonderful place to live. But on top of that, my top three priorities will reflect the challenges we face.

- We need to address our staffing vacancies - We will soon lose our City Manager, and the Finance Director position remains vacant, among other positions. Nothing can be accomplished if we do not have a sufficient level of city staff.

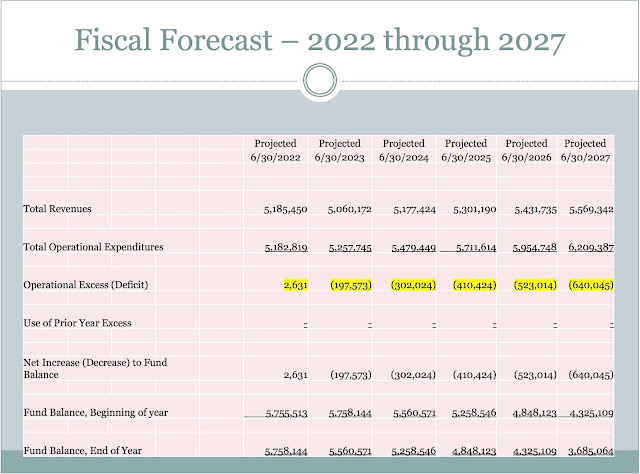

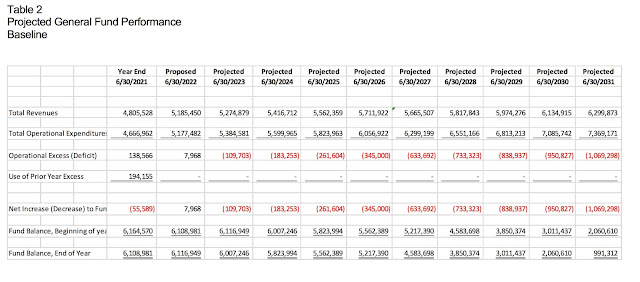

- We need to address our budget shortfalls - Deficit spending is not sound public policy and while it may at times be necessary, we need to address our structural issues. First by examining our expenses and cost structure, then by looking at our fee schedules and any other non-tax revenue options. This will take a bit of time but it is work we need to be doing.

- This may be the hardest one – but I think it important all the same. I want to find a way to reduce the polarization and heated rhetoric that has served to crowd out reasonable discourse. In our small town, it is not healthy for passions to overwhelm reason. I say this may be the hardest one because when the loudest voices dominate the dialogue, it creates a poor information feedback loop when all people see and hear are the loud voices. We should always be welcome to criticize policies, but when that criticism attacks the person rather than the policy it becomes toxic.

We will never have an environment where there are no such toxic voices, because free speech and people can choose how they behave. But I lay down the challenge to the rest of us, that when we see or hear such toxicity, we look to the better angels of our nature and choose not to engage.

I look forward to working with the rest of the Council to bring these goals to fruition.

Friday, December 2, 2022

Upcoming Council Meeting 12.6.22

Wednesday, November 16, 2022

Election Results - Update

While still not final, the County has released the latest update on vote counts. County wide, there remain approximately 1,800 provisional ballots and approximately 5,000 other ballots. Since this is County wide, only a small number of those would be expected to be from Clayton. Current ballot count is at 5,745 out of 8,477 registered voters, which is a 67.77% turnout rate.

It looks like myself and Kim Trupiano have earned a seat on the Council for the next four years. Our next scheduled Council meeting on 12.6.22 will have the swearing in ceremony but otherwise be a light agenda.11.15.22 Meeting Summary

Saturday, November 12, 2022

Upcoming Council meeting 11.15.22 and Join me at Ed's Afterwards

Wednesday, November 9, 2022

Thank You! Results not final yet

To those who volunteered to canvas – Thank you. It takes a tremendous amount of time and energy to canvas and without your efforts I would have not gotten to nearly as many people as we did.

To those who were willing to show support by putting up yard signs, sometimes multiple – Thank you. At times it can be difficult putting yourself out there, inviting those questions and conversations from friends and neighbors but those conversations are truly the most impactful and I am grateful.

To those who spread the word online and in person – Thank you. I've always believed that leaders should meet people where they are. Today quite a few people interact online and my intent is to continue to have conversations with people this way. Passionate community involvement is what can drive change and with our ability to connect and collaborate we can be truly effective.

To all other supporters - Thank you. The only way this campaign has gotten this far is both because the message has resonated with people, and they were able to hear that message. The only way that was possible is because of the vocal support of the community.

And to my fellow candidates - Thank you. Though we may disagree from time to time on matters of policy, healthy debate and discussion is part of the process. Anyone who decides to put themselves out there for public office is to be commended on their willingness to step up and serve.

More information to follow both on this website and my Facebook page, but for now I'm going to get some much needed rest with the family.

Friday, November 4, 2022

Last Thoughts on my Campaign and Remember to Vote on November 8

The city has a lot of work ahead to increase operational efficiency and fiscal discipline. Unless and until that happens I will not support any revenue measure. I know Kim Trupiano feels similarly. If elected, Kim and I add up to two which shuts down the possibility of more taxes and we can instead, shift our focus away from squandering resources with useless surveys and trying to increase taxes and instead, focus on serious discussions about cost savings, efficiencies, and other ways to reduce our overall expenditures – what we should have been doing since I raised this issue back in the middle of 2021.

Wednesday, November 2, 2022

11.1.22 Meeting Summary and my Candidate Statement

The District is governed by a a Board of Trustees. The Board of Trustees are officials appointed by their respective city councils to govern the Mosquito and Vector Control District knowledgeably and effectively. They serve without compensation but are provided with an allowance to defray expenses while on official business (not to exceed $100 per month). Trustees do not receive any type of benefits and serve for a term of two to four years.

Monday, October 31, 2022

Upcoming Council Meeting 11.1.22

If you have thoughts or questions regarding the above, please let me know.

Sunday, October 30, 2022

A Lack of Leadership and Gaps to Fill

In the four years I’ve been a member of this Council, I’ve been in the minority on a number of issues. It’s time to change that. Because if we continue down this path, with our leaders more interested in attending gatherings and going to meetings with no discernable outcome, rather than focusing on basic operations like maintaining a schedule of maintenance activities, or balancing the budget – then we as a city will continue to hemorrhage good people and city operations will suffer.

After November, the newly constituted Council will be tasked with rebuilding these critical staff positions. Now more than ever we need strong leadership to guide the city and staff in both the hiring and onboarding of new personnel. It will be paramount to have Councilmembers who have experience in hiring staff and building and managing teams.

While I started my career as a governmental auditor, I’ve been a people leader for over 20 years. As Vice President and Controller of a multi-billion dollar company, I have extensive experience in managing budgets and finding and retaining talent - from entry level positions to Directors, in office personnel and remote workers. Having this experience will be critical as we rebuild the team at City Hall.

This is why it is so important that our former Finance Director, Police Chief, and the Police Officers Association representing all of our police have all endorsed me in this election. These are folks that are NOT politicians, but they have deep and recent knowledge of city operations. They have first hand experience working with me and want to continue working with me and in each case I have gained the support of city staff – something critically important as we move forward.

Election day is November 8. I’m asking for your support and your vote.

Monday, October 24, 2022

Issues of Substance and Policy

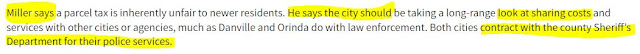

Laying off our police and using the Sheriff's Department would yield a higher cost, and a reduced level of services and would be a detriment to public safety in Clayton. This is part of the reason why the Clayton Police Officers Association endorsed me and not Mr. Miller.

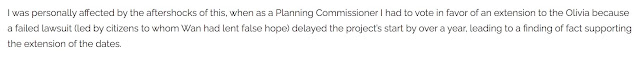

“Upon a showing of good cause therefor, the Planning Commission may extend the

period of a permit in which it is to be exercised, used or established, for a maximum

of twelve (12) months at a time or as otherwise specified on the permit.”

Friday, October 21, 2022

October 24 is the Last Day to Register to Vote

If you have not yet registered to vote for the November 8 election, the last day to do so is October 24. You can check your registration status here: https://voterstatus.sos.ca.gov/

To register to vote, you can do so online here: https://registertovote.ca.gov/. Then vote for me and Kim Trupiano. www.kimforclayton.com

Thursday, October 20, 2022

On Flyers, Attacks, and Civility

While I support everyone’s right to express themselves in whatever manner they see fit, at times that occurs in ways that I personally do not approve of. To be clear, I do not condone or support these tactics.

My goal throughout this campaign has been to be as clear as possible regarding my positions and how we should move forward as a city. This is why I write in detail at my campaign website. My preference is that residents support candidates of their choosing that best represents their interests. If that is me, then that is fantastic. If it is not, I respect people’s choices and that is the process. I wish all the candidates the best of luck this November.

Wednesday, October 19, 2022

10.18.22 Meeting Summary and My Candidate Comments

Monday, October 17, 2022

Upcoming Council Meeting 10.18.22

- Consider executing contract with Climatec. This would be a consulting agreement for Climatec to do an assessment of where the city could save money by implementing various energy conservation improvements. The agreement calls for two phases - the first would be a review and assessment. There is no cost to the first phase. If there are areas of improvement identified in phase 1, then phase 2 may commence upon authorization from Council to do the identified projects. Phase 2 work would be a cost plus basis. Only projects that would meet the marginal ROI necessary would be approved.

This may sound familiar as we were on deck to engage in this work back in December 2020, however due to timing with coordination with the City of Concord we tabled the issue until now.

Saturday, October 15, 2022

Raising Taxes and Counting to Two

Friday, October 14, 2022

Ed Miller's Loose Relationship With Facts

"“Upon a showing of good cause therefor, the Planning Commission may extend the

period of a permit in which it is to be exercised, used or established, for a maximum

of twelve (12) months at a time or as otherwise specified on the permit.”

The municipal code clearly places the burden on the one seeking the extension - but Miller claims he could find no reason to deny. That is a misunderstanding of where the burden lies. Further, there is no standard by which "good cause" is defined. Here the City may define what is sufficient to constitute good cause and unfortunately for Miller and the rest of Clayton, he didn't take the time to understand the law.

Wednesday, October 12, 2022

Yard Signs All Distributed - Other Ways to Help

Tuesday, October 11, 2022

Candidate Forum Recap and Another Endorsement

Last night all four candidates for the two open Council seats participated in a forum sponsored by the League of Women Voters of Diablo Valley, AAUW of Clayton, the CBCA, the Clayton Community Library Foundation, and the Clayton Garden Club. I’m grateful to these organizations for hosting this important event.

Because of time constraints, candidates were limited to one minute for each response and many questions were actually several questions combined. I have written extensively on many of the items raised and will do so more in the future so I encourage everyone to visit my website at jeffwanforclaytoncitycouncil.net to learn more.

While other candidates touted their experience working in government, only Kim Trupiano talked about actually being responsible for a budget, or managing teams. Experience in these areas will be critical as we move forward. As a CPA, and Vice President and Controller of a multi-billion dollar company, I have extensive experience being responsible for budgets, projects, and teams. There will always be new things to spend money on but being a fiscal steward means prioritizing competing needs with the resources available.

It is certain that city finances will be a key issue to

be addressed in the near term. Recently I

spoke with Paul Rodrigues. Paul is also

a CPA, and Clayton’s former Finance Director.

He took an opportunity last year to use his talents as the Finance

Director for the City of Pittsburgh. Paul

has strongly endorsed my campaign, saying that I have been spot on with my

financial analysis and concerns, going on to say that I am the only Councilmember

who truly understands the finances of the City of Clayton.

Our former Finance Director, Chief of Police, and the Clayton Police Officers Association representing all of our police have now endorsed my campaign. These are individuals that have deep knowledge of our city and understand its challenges, have seen my work, and recognize that advancing my ideas will help Clayton move forward. I’m grateful for their support.

Ballots have been mailed and should be received soon. I humbly ask for your support and your vote so that I can continue leading Clayton on the path forward.

Friday, October 7, 2022

Endorsed by the Clayton Police Officers Association and Former Police Chief Elise Warren

Wednesday, October 5, 2022

10.4.22 Meeting Summary

Sunday, October 2, 2022

Upcoming Council Meeting 10.4.22

Friday, September 30, 2022

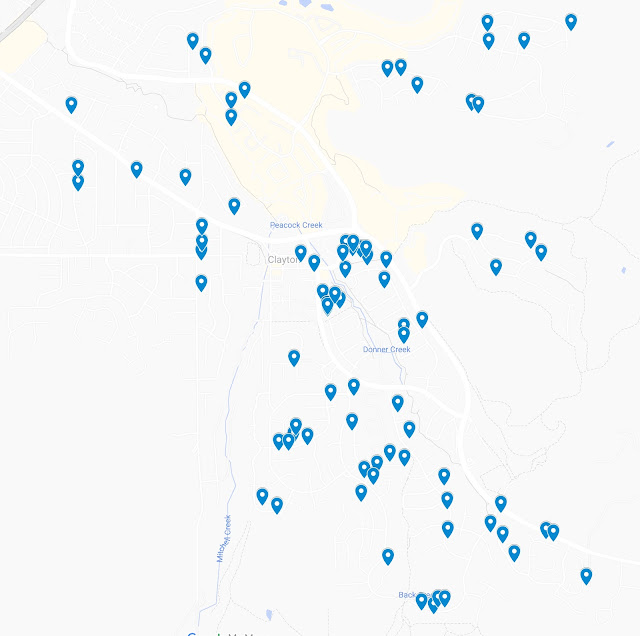

Volunteers Needed - Please Sign Up

I am targeting 10/15/22 to distribute door hangers and am asking for volunteers. To facilitate the signing up for various areas, I have created the following sign up sheet. Please click this link to sign up: https://www.signupgenius.com/go/10c0e4aa8a82da6fece9-volunteer

Once you are signed up, we will establish a central meeting place to distribute materials and depending on the number of people we can subdivide the areas even further. The more people we have the better, but I am asking for approximately 2 hours or so.